Analysis of the current development status of the carbon fiber industry in our country

2021-05-17

1. Introduction and Classification of Carbon Fiber

Carbon fiber is an inorganic fiber with a carbon content of over 90%. It is produced by the pyrolysis and carbonization of organic fibers in a high-temperature environment, forming a carbon backbone structure. Carbon fiber has excellent mechanical and chemical properties. As a new generation of reinforcing fiber, carbon fiber possesses the inherent characteristics of carbon materials while also having the softness and processability of textile fibers, making it widely used in fields such as new energy and transportation.

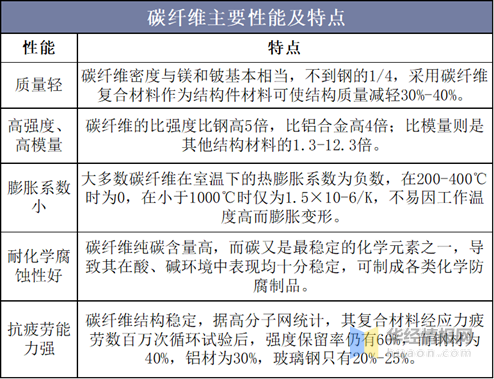

Main Properties and Characteristics of Carbon Fiber

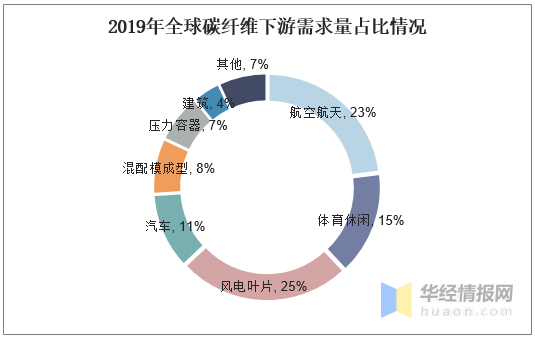

Carbon fiber can be classified according to various dimensions such as precursor type, manufacturing conditions and methods, mechanical properties, fiber morphology, and bundle size. Different types of carbon fiber have different applications in various fields. Among the precursor types, polyacrylonitrile (PAN) based carbon fiber occupies a dominant position, accounting for over 90% of the total carbon fiber production, while viscose-based carbon fiber accounts for less than 1%.

Classification and Characteristics of Carbon Fiber

Source: Compiled from public data

2. Current Development Status of the Global Carbon Fiber Industry

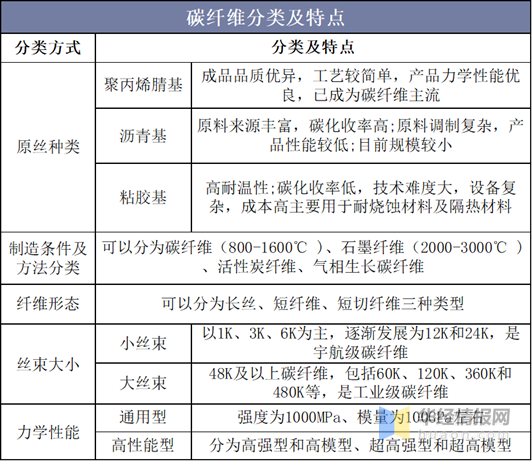

In 2019, the global demand for carbon fiber reached 104,000 tons, a year-on-year increase of 12%, with a value of 2.87 billion USD, an increase of 11.6% year-on-year. From 2008 to 2019, the compound annual growth rate of global carbon fiber demand was 10.12%. This is the first time in over 60 years of global carbon fiber development that demand has exceeded 100,000 tons, directly reflecting the continuous expansion of downstream demand for carbon fiber. As countries increase their investment in carbon fiber, core technologies will continue to break through, significantly shortening the time required for the next 100,000 tons of demand growth. It is projected that by 2025, global carbon fiber demand will reach 200,000 tons, and by 2030, it will reach 400,000 to 500,000 tons.

Statistics on Global Carbon Fiber Demand and Growth Rate from 2008 to 2019

Source: Compiled from public data

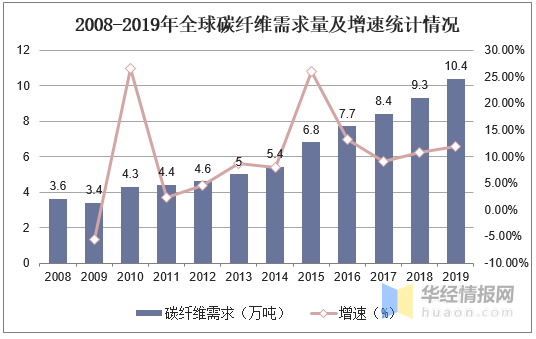

Proportion of Global Carbon Fiber Downstream Demand in 2019

Source: Compiled from public data

3. Current Development Status of China's Carbon Fiber Industry

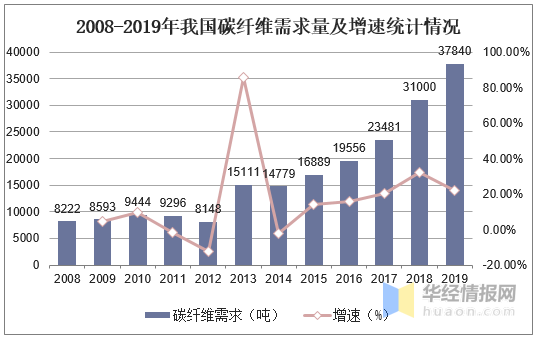

China's demand for carbon fiber has rapidly increased, growing nearly fivefold in 12 years. From 2008 to 2019, China's carbon fiber demand increased from 8,000 tons to 38,000 tons, with a compound annual growth rate of 15.22%. In 2019, China's carbon fiber demand accounted for 36% of the global total demand. It is expected that by 2025, China's total carbon fiber demand will reach 119,000 tons.

Statistics on China's Carbon Fiber Demand and Growth Rate from 2008 to 2019

Source: Compiled from public data

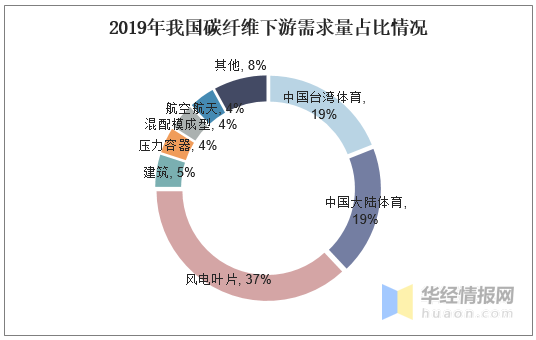

China's carbon fiber demand mainly comes from wind turbine blades and the sports and leisure sector. In 2019, the demand for carbon fiber in wind turbine blades was 13,800 tons, a year-on-year increase of 72.5%, accounting for 36.5% of the total demand. Among this, domestic carbon fiber accounted for about 1,000 tons, marking the first step towards domestic substitution compared to complete imports in 2018. The sports and leisure sector is the largest source of domestic carbon fiber demand. In 2019, the combined demand for carbon fiber in the sports and leisure sector in mainland China and Taiwan was 14,000 tons, with a year-on-year increase of 4%, accounting for as much as 37% of the total demand.

Proportion of China's Carbon Fiber Downstream Demand in 2019

Source: Compiled from public data

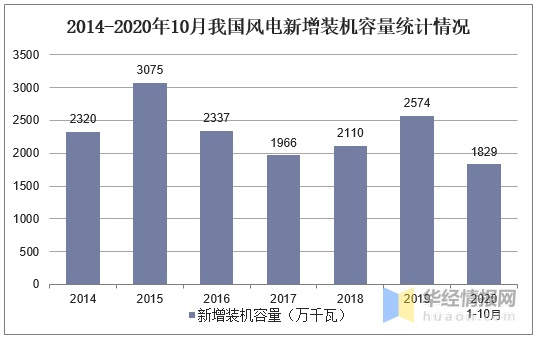

In China's carbon fiber industry, the downstream demand for wind turbine blades accounts for nearly 40%, with a proportion of 37%. Carbon fiber can effectively reduce the weight of wind turbine blades, promoting the development of wind power generation towards higher power outputs. To better balance the weight and length of the blades, carbon fiber composite materials have become the ideal choice for wind turbine blades. China's wind power market is rapidly expanding, making it an important market globally. In 2019, the global newly installed wind power capacity reached 60.4 GW, a year-on-year increase of 19%; in the first ten months of 2020, the newly installed wind power capacity in the country was 18.29 million kilowatts, a year-on-year increase of 3.63 million kilowatts. China has built the world's largest clean energy system, which will promote the clean, low-carbon, safe, and efficient utilization of energy, accelerating the development of new energy and green environmental protection industries. In this context, China's wind power industry will drive the rapid development of the carbon fiber industry.

Statistics on Newly Installed Wind Power Capacity in China from 2014 to October 2020

Source: Compiled by Huajing Industry Research Institute

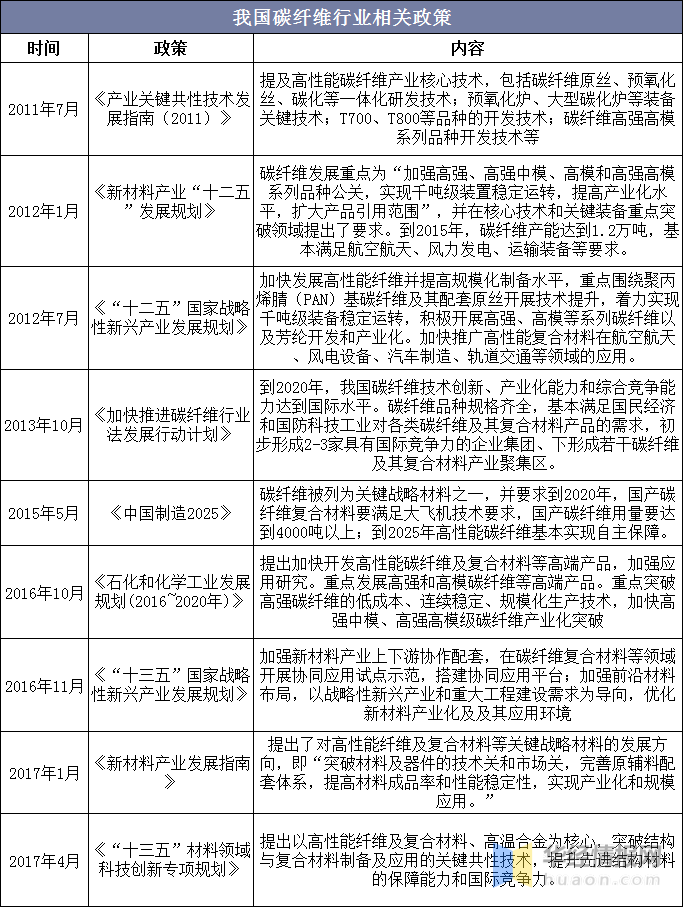

4. Relevant Policies of China's Carbon Fiber Industry

As a strategic new material, carbon fiber composite materials are known as the 'king of new materials.' Since 2011, China has introduced multiple policies to promote the research and industrial application of carbon fiber and its composite materials, continuously driving the development of the carbon fiber composite materials industry.

Relevant Policies of China's Carbon Fiber Industry

Source: Government announcements, compiled by Huajing Industry Research Institute

Key words:

Previous:

Next:

Related News

Prepreg - Weihai Lanke Composite Material

2021-08-04